Why A “Bbbee Verified Measured Entity” Score Of 4 Or Below Matters For South African Companies

The Broad-Based Black Economic Empowerment (BBBEE) Act in South Africa aims to address historical economic inequalities and promote inclusive economic participation. Achieving a favourable BBBEE rating has become increasingly crucial for businesses operating in the country, with a score of 4 or below acting as a critical benchmark.

A BBBEE Level 4, means that your company is either, an Exempt Micro Enterprise (EME) with a turnover LESS than R10 Million a year, and that you do not have to comply with a Sectoral Scorecard but instead fall under the General Scorecard covering all companies in the Economy. (If you are however verified in a specified Sector, such as Construction, you will be measured against that Sectoral Scorecard. If this is the case, as an EME in Construction, you will only ever gain a Level 5 Measured Entity status, as a White Owned business with a turnover less than R10 Million.

It is necessary to emphasise that in either the general or sectoral case, you are classified as having been “Verified by Affidavit”. If you have a verification by affidavit, some Industries such as Mining are excluding companies from Tenders and Contracting because they won’t accept this route to Verified Status.

To qualify for Tenders and RFQ’s your company will generally have to be Verified across ALL 5 ELEMENTS of the BBBEE Scorecard, via an actual BBBEE Audit, conducted by a SANAS Accredited Auditor.

Procurement Credit

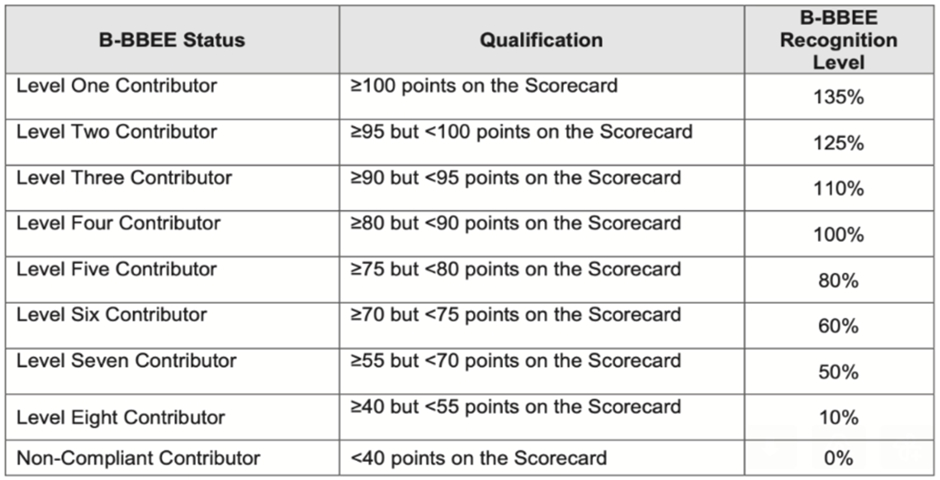

With reference to the table above, it is important to note, is that a Level 4, offers your Customers certainty that for their own scorecard, you will be giving them 100% Procurement Credit, for any amount spent. A Level 5 means your status, penalises their status, by 20% because only 80% Procurement Credit will be earned by your customers on their spend with you, for their own Scorecards.

Procurement Credit is important, because full scorecard points for the Procurement Element require that a company spends a minimum of 80% of their procurement budget with measured entities. If your customer loses this credit when doing business with your company, they have to make it up by doing business, with other measured entities with Levels 3/2/1 where they are able to earn bonus Procurement Credit Points to compensate for doing business with you.

The BBBEE Generic Scorecard assesses companies across seven elements:

- Ownership: Measures the percentage of ownership held by black South Africans.

- Management Control: Evaluates the representation of black South Africans in senior management positions.

- Skills Development: Assesses 6.3% of Payroll investment, in training and development of black employees.

- Preferential Procurement: Assesses the procurement of goods and services from black-owned suppliers, and includes:

- Enterprise Development: Measures support provided to CREATE black-owned businesses.

- Supplier Development: Measures efforts to CONTRACT and DEVELOP the capacity of black-owned suppliers to fit into your companies Supply Chain.

- Socioeconomic Development: Evaluates contributions to community development and social upliftment.

The Significance of a Low Score (4 / 3 / 2 or 1):

Achieving a BBBEE rating of 4 or below unlocks numerous benefits for your company:

Increased Market Access: Many government tenders, contracts, and licenses prioritise companies with ratings of 4 or below. A high score above 4 can significantly limit your access to these opportunities, hindering your market reach and growth.

Enhanced Reputation: Demonstrating commitment to transformation through a BBBEE rating of 4 or below, strengthens your brand image and reputation, attracting ethical investors and talent.

Improved Supplier Relationships: By partially prioritising black-owned suppliers, you foster stronger relationships within the business community and contribute to broader economic empowerment.

Financial Incentives: Certain tax breaks and government grants are tied to achieving a specific BBBEE level. A high score means missing out on these potential financial benefits.

Compliance and Risk Management: Maintaining a compliant BBBEE status minimises the risk of legal penalties and reputational damage associated with non-compliance.

Reduced Customs Duties: Some imported goods qualify for reduced customs duties based on the importer’s BBBEE rating. This can lead to cost savings and make imported goods more competitive.

The Broad-Based Black Economic Empowerment (BBBEE) Set-Off Scheme: This scheme allows companies to deduct a portion of their qualifying BEE expenditure from their taxable income. The amount deductible increases with a higher BBBEE score, providing a tax advantage.

Qualification for Specific Grants and Support Programs: Certain government grants and support programs, such as the Black Business Incubator Programme and the Tourism Equity Fund, prioritise applications from companies with high BBBEE ratings.

Access to Loan Guarantees: There are financial institutions that offer loan guarantees with more favorable terms to companies with good BBBEE scores. This can make it easier for qualifying businesses to access funding.

Improved Investor Relations: Many investors today consider a company’s BBBEE rating when making investment decisions. A strong rating can attract ethical investors and potentially improve access to capital.

Here’s how BBBEE impacts customs duties:

Customs Duty Rebates

Importers with valid BBBEE certificates can apply for rebates on customs duties paid on qualifying goods used in specific manufacturing or production processes. These rebateable goods belong to specific classifications within the Harmonized System (HS) codes, not product names.

General Rebates:

Certain industries with declared national economic priorities can access general rebates on specific HS codes, regardless of the importer’s BBBEE rating. For example, rebates exist for the clothing and textile industry to encourage local production.

To determine if a specific good qualifies for a rebate based on your BBBEE rating, you need to consider:

- Your BBBEE certificate level: Only accredited BBBEE certificate levels (Levels 1-7) qualify for rebates.

- The HS code of the imported good: Check the relevant HS code in the tariff book and consult the Customs and Excise Act or official resources for rebate information linked to that code.

- The purpose of the import: Rebates generally apply to goods used in manufacturing or production, not final consumption.

Tax Benefits of Transformation:

Demystifying the BBBEE Set-Off Scheme

The Broad-Based Black Economic Empowerment (BBBEE) Set-Off Scheme in South Africa offers more than just a feel-good approach to transformation. It provides a tangible tax advantage to companies actively committed to empowering black South Africans. In this article, we unravel the scheme’s mechanics and explain how a higher BBBEE score translates to greater tax savings.

Understanding the Scheme

The scheme allows companies to deduct a portion of their qualified BEE expenditure from their taxable income. This reduces their overall tax liability, essentially offering a financial reward for investing in transformation initiatives. Qualifying expenditure includes various categories like black skills development, enterprise development, socio-economic development, and preferential procurement from black-owned suppliers. The deductible percentage is directly linked to your BBBEE score. Scores of 4 or below, unlock higher deduction rates, incentivising companies to strive for continuous improvement.

A Case Study of the Score Advantage:

Let’s say Company A holds a Level 4 BBBEE rating, allowing them to deduct 100% of qualifying skills development expenditure. Company B, however, stands at Level 3, enabling them to deduct 120%. This seemingly small difference can translate to significant tax savings over time, motivating Company A to further its transformation efforts.